1. Set your thermostat to 64 and turn it down to 60 at night.

2. Use the phone book instead of directory assistance.

3. Use coupons at the grocery store.

4. Carpool.

5. Ask for generic prescriptions instead of brand name.

6. Do your own nails.

7. Rent out a room or garage.

8. Replace 100 watt bulbs with 60 watt.

9. Make long distance calls at night and on weekends, instead of mid-day, mid-week.

10. Throw pocket change in a jar and take it to the bank when it’s full.

11. Always grocery shop with a list. Shoppong with a list will save you money on your grocery shopping, as long as you stick to what's on the list. Another way to say it, "Don't buy on impulse.

12. Buy spare parts for your car at a junkyard.

13. Go to museums on free days.

14. Quit smoking.

15. Get hand-me-down clothes and toys for your kids from family and friends.

16. Switch to water when dining out.

Restaurants make a killing on drinks. Getting water instead, is not only healthier, but at free, much cheaper.

17. Brew your own Coffee, rather than buying it on the run.

If you have two cups a day at $1.50 each workday, that’s $60 over a month. You can buy a decent coffee maker, really good bean or ground coffee, and a Stanley stainless steel insulated thermos for about $45 and come out $15 ahead just the first month!

18. Take a shorter shower.

19. Write letters instead of calling.

20. Brown bag your lunch.

21. Make your own baby food, when I was a teenager and my parents had an another kid, I remember mom doing this. It was a simple as putting the peas (or whatever vegetable) in the blender.

22. Use public transportation.

23. Drop duplicate medical insurance.

24. Buy old furniture at yard sales and refinish it yourself.

25. Apply for scholarships and financial aid.

26. Exercise for free walk, jog, bike, or get exercise videos from the library.

27. Form a baby-sitting cooperative with friends and neighbors.

28. Buy your clothes off season.

29. Go to a matinee instead of an evening show.

30. Share housing with a friend or family member.

31. Hang clothes out to dry.

32. Do not use your calling card.

33. Volunteer two hours a month for reduced cost food through the Share Program.

34. Change the oil in your car yourself regularly.

35. Get pre-approval from your medical insurance company before undergoing any procedures or tests.

36. Buy "no frills" vitamins.

37. Take a date for a walk along the beach or in the woods.

38. Make cards and gifts for friends.

39. Shop thrift stores.

People give away some really nice things! I recently picked up a College shirt, that I have really been wanting for $2, that at the University Bookstore sells for about $30.

40. Have your water company do an audit so you are not charged sewage fees for water used in your garden.

41. Refinance your mortgage.

42. Grocery shop on double coupon days.

43. Trade down your car for a less expensive, lower maintenance one.

44. Convert your cash value life insurance to term.

45. Shop around for eyeglasses.

46. Do not be shy about pulling something you like out of the trash.

With a little refurbishing, it could be as good as new for a few more years.

47. Recycle.

48. Move to a less expensive place to live.

49. Use low flush toilets or water saving devices in the tank.

50. Drop unneeded telephone services like call forwarding or caller ID.

51. Buy fruits and vegetables in season.

52. Avoid using your ATM card at machines that charge a fee. Paying fees 0f $1,$1.50 or more at ATM machines can add up quickly. Remember, when you use another banks ATM, the charge isn't just from that ban, but yours as well so the charge can be double what you agree to at the ATM.

53. Bicycle to work. Using leg pwer, instead of gasoline, can save hundreds of dollars each year.

54. Shop around for auto insurance discounts for multiple drivers, seniors, good driving records, etc.

55. Ask your doctor for samples of prescriptions.

56. Borrow a dress for a big night out. or go to a consignment shop.

57. When you buy a home negotiate the sales price and closing costs.

58. Turn the hot water heater down and wrap it with insulation.

59. Never grocery shop hungry.

60. If you qualify, file for Earned Income Credit.

61. Shop around for prescriptions including mail order companies (Medi-Mail 800-331-1458, Action Mail Order Drugs 800-452-1976, and AARP 800-456-2277).

62. If you pay for childcare, make use of the dependent care tax credit or your employer’s dependent care flexible spending account.

63. Buy, sell, and trade clothes at consignment shops.

64. Shop around for the lowest banking fees.

65. Caulk windows and doors.

66. Iron your own shirts.

67. Plan your weekly food menu before shopping.

68. Buy a good used car instead of a new model car.

69. Purchase all of your insurance from the same company to get a discount.

70. Cut your cable television down to basic.

71. Go to an optometrist for routine vision tests or to change an eyeglass prescription.

72. Buy pre-owned toys and children’s books at garage sales.

73. Have potluck dinners with friends and family instead of going out. I think I like this one best. What a great way to have a "dinner party" and save money as well. The only problem might be, where to have it.

74. Use the library for books, video tapes, and music.

75. Inspect clothing carefully before purchasing it.

76. Don’t use your dishwasher dry cycle; open the door and let them air dry all night.

77. At the grocery store, comparison shop by looking at the unit price.

78. Make your own coffee.

79. Use old newspapers for cat litter.

80. Shop at discount clothing stores.

81. Skip annual full mouth x-rays unless there is a problem; the ADA recommends x-rays every 3 years.

82. Water your garden at night or early in the morning.

83. Shop around for long distance rates.

84. Hand wash instead of dry cleaning.

85. Grow your own vegetables and herbs.

86. Buy generics, when grocery shopping.

If you can get past the preconceived notion, that generic is a lesser quality, you will find many of these items are just as good. In addition, if you don't think so, many stores guarantee their quality. Granted there are about 5 items I wont buy generic, but most things I will.

87. Donate time instead of money to religious organizations and charities.

88. If you are leaving a room for more than five minutes, turn off the light.

89. Shop at auctions or pawn shops for jewelry and antiques.

90. Keep your car properly tuned.

91. Request lower interest rates from your creditors.

92. Trade in old books, records, and CDs at book and record exchanges.

93. Pay bills the day they arrive; many credit card companies charge interest based on your average daily balance.

94. Buy software at computer fairs.

95. Search the Internet for freebies. but not for free software - free software is loaded with adware and spyware, that's why it is free.

96. Compost to make your own fertilizer.

97.If your car has very little value, you probably only need liability insurance.

98. Cut the kids hair yourself.

99. Increase your insurance deductible.

100. Buy in bulk food warehouses.

101. If your income is low, contact utility companies about reduced rates.

Friday, September 29, 2006

Great Mural Wall of Topeka: Meeting Minutes: 9/28/06

I took the bottom one straight on, but the flash reflected and blocked out part of it, so I took the top one at an angle. between the two you should be able to read everything but I think you can still read everything . Roy O'Neil

Individuals attending the meeting were Larry Wilson, Shirley Tibbits, Edna Beaty, Kevin Surbaugh, Mike Jackson, Tom Benaka, David Loewenstein, and Roy O’Neil.

The first mural will be on the East side and the south side of the wall. On the East side the theme will relate to the past and on the South it will relate to things happening now or today.

Think of one story or myth of Topeka, Chesney Neighborhood, WU or Expo Centre that we can illustrate for Saturday’s meeting.

Materials and sources include photos, magazines, pictures, and articles, Etc. Be sure to bring these ideas to the meeting Saturday.

Slides of murals were looked at.

Themes or general ideas for our 60 feet mural included;

Nature-----plants----animals----kids----Chesney Park

State---- Kansas’s icons

Topeka----the arts---- celebration of the arts----myths or legends

Historical Events

Well known people

Fair----Arch at 17th and Topeka day and night

Archways----fair----dirt track racing----railroad

Chesney Park----kids----ethnic diversity----multi cultures

Industry

Native Agriculture

Americans

A second list included the following themes:

Nature plants and animals

Chesney Park pool, bandstand, ponies

Kansas flower and birds

Arts celebration of myths and legends

Events inventions, railroad

Well-known figures

Fairgrounds Arch

Sky, day, night

Park

Welcome to Chesney Park

Architecture

Cultures, ethnic diversity

Agriculture

Industry

Economy

Native Americans

Sense of humor

Washburn girls win National Championship

Friends/family

Next meeting: 1pm Saturday Sept. 30

October 1st Update

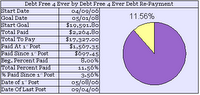

Okay, so I know this is a day early, but I was able to get all my figures in and figured, so here is my budget update for the month of September.

With the help of an unexpected $1000, I was able to get rid of some medical bills that were not figured in my debts chart. In addition, I was able to get paid far enough ahead on my car loan, that I can now pay it weekly and not get behind by the due date. This will help save me countless dollars in future interest.

Over all I seen my debt chart reduce by $803 dollars leaving a balance still owing of $16,524 (or 15.65% paid).

Pictures of 9/23/06 Planninng Meeting

Thanks to Roy O'neal who has been taking pictures of this project as it has been progress. Here are some the pictures from our meeting Sat. Sept. 23, 2006. Along with some notes from Tom.

Bring pictures, illustrations, photograph's etc. of Chesney Park Neighborhood, WU, Expo Centre and Topeka.

Think of or ask others for story or tale about Chesney Park Neighborhood, WU. or Topeka that can be illustrated.

Tom said the minutes of Thursdays meeting will be posted Friday or Saturday.

Top right: The Mural Committee Meets

Center & Bottom left: The Committee chooses the spot

Center Right: Shirley Tibbits discusses the mural with Charlotte Noland.

In the picture at the left the Mural Committee looked over the wall for a possible starting point with the first mural section.

The next Mural Team meeting will be 1pm Saturday September 30

Bring pictures, illustrations, photograph's etc. of Chesney Park Neighborhood, WU, Expo Centre and Topeka.

Think of or ask others for story or tale about Chesney Park Neighborhood, WU. or Topeka that can be illustrated.

Tom said the minutes of Thursdays meeting will be posted Friday or Saturday.

Top right: The Mural Committee Meets

Center & Bottom left: The Committee chooses the spot

Center Right: Shirley Tibbits discusses the mural with Charlotte Noland.

It is my hope that when this project is complete over the next few years that "the Great Mural Wall of Topeka" will rival "the Great Wall of Los Angeles."

- Kevin S.

In the picture at the left the Mural Committee looked over the wall for a possible starting point with the first mural section.

Monday, September 25, 2006

Great Mural Wall of Topeka:Planning Meeting: 9/23/06

In attendance : Shirley Tibbits, Betty Bond, Mike Jackson, Charlotte Noland,

Margaret Venable, Debra Guerra, Kevin Surbaugh, Edna Beatty, Roy O'neil,

Rachel Donaldson, Mark Benaka, Larry Wilson, John Casson, Joe Marshall,

Linnzi Fusco, Tom Benaka, David Loewenstein

Introductions of group members

Noted that leader of our mural is David Loewenstein.

Business-picking themes for mural, painting section of wall, (w/good weather)*can work on mural in shifts or in studio depending on working capabilities.

Questions-allotting wall space to schools- David is not sure but plenty of space for everyone to use.

Weather cancellations- Will be sent via email, if no email will call, if you have questions 's Please call frank 235-6344 or 231-8046.

Meeting times-Must be at least 50 degrees in order to paint, design needs to meet 2x's a wk. Not required to attend each meeting, but encouraged. Times are: Saturdays @ 1 pm and Tuesdays @ 6:30 pm.*Mural painting is every day starting@ 10 am till dark. This needs to be done by the beginning of November. All meetings will be 2hrs. long.

Timeline of project: Meet 5x's before work can be compiled. Drawings, collage, photographs will all be compiled.

Next meeting: Themes of our section of wall, ideas *Meets Tuesday @ 6:30 pm-8:30 pm. Want to be painting by mid October, due to weather conditions (fall coming, colder weather). Paint will not adhere under 50 degrees!

Idea sheets were passed out from 1st brainstorming meeting 1 mo. ½ ago, and photos of wall areas of interest, 1st section is 60 feet X 11 feet.

-Slides were presented by David, he explained how he got into mural painting. David talked about his new book “Kansas Murals.” Showed slides of other murals in Kansas and other places he has worked on murals, and the history / back ground of their subject. He also showed slides of other murals throughout the world by other artists.

*We want mural to be visible and meaningful.

-Release forms were passed out for group members.

-Group took a walk to see actual wall area. NE end, or 30 feet on opposite sides of corner, middle of E wall (Expo. Cntr. exposure). Want to put history on this area (middle E section) of “Free Fair.” (Pictures on top right)

-Was decided that section overlapping S and E corner would be the starting point of mural project (corner of 20th & Western).

David Loewenstein's phone # 785-550-8531.

-Next meeting bring any ideas, art supplies you want to use (if you like, David will provide some media) and be ready to design!

We still need about $5,000, so if you know any contributors….please send them our way!!! (Pictures on Right)

Saturday, September 23, 2006

Heartland Share Day

Today is Heartland Share Day.

Today is Heartland Share Day.What is Heartland Share?

Topeka-based Let's Help Inc. launched Heartland SHARE in November 1991. Heartland SHARE is modeled after a program established several years earlier in California that gives participants the opportunity to purchase a box of groceries at a reduced price, provided they have given two hours of volunteer time in their community. Over the years, the Heartland SHARE program grew to include local distribution sites throughout Arkansas, Kansas, Missouri, Nebraska and Oklahoma.

Heartland SHARE offers a great-tasting, nutritious grocery package at up to half the retail cost in exchange for 2 hours of volunteer service in your community.IE: A fantastic way to save on you grocery bill. Pacakage pick-up is between 8:30am and 9:30 am today.

Anyone can participate in Heartland SHARE because everyone has something to contribute.

There are several programs simaler to Heartland Share, but none of them are the size and scope of the Topeka, KS based Heartland Share that covers Kansas, Nebraska, Missouri and Arkansas.

One "share" costs only $18 + 2 hours of volunteer time. A person can buy as many shares as they want. While this is my first time buying a share, it is certainly not the first time I have heard of them. Infact, a former President of the board ran for the state senate a few years back, and I went down to their warehouse for a commercial to be used by his campaign. I along with others were in the background moving food around.

This months share (menu) includes:

2 lbs. lightly breaded chicken breast bites

1 lb. skinless, boneless chicken breasts (Individually Quick Frozen)

.75 lbs. cubed sirloin beef tips

.5 lb. Meatballs

.75 lb. chub pure pork sausage

(2) 1/2 lb. ground beef patties

6 potatoes

3 onions

1 sleeve celery

(1) 1 lb. bag slaw mix

5 Gala apples

5 oranges

5 plums

(1) 1 lb. bag red grapes

(1) 5.5 oz. package spiral macaroni and cheese

All for the low price of $18 plus a $1 handling fee and 2 hours of volunteer service. A $2 transportation fee will be added in some locations.

Other Programs I found in Yahoo Search:

Wisconsin Share

Toronto Canada

Iowa

Share Colorado

and there are others all over the USA and Canada, but the one right here in Topeka is the one the feds want to see copied.

You should deffinatly find your communities "share" program," it is a great way to save on your grocery bill.

****UPDATE*****

Heartland Share ran into financial troubles and merged with another program. Their new address is:

http://sharecolorado.com/

Fianlly Got Started on Ebay

Friday, September 22, 2006

What Is The Deal??

So last week, blogger went down. While I was able to make my update, no one was able to access any blogger sites for an hour or two. Now, ever since that time, every post I make shows up in PfBlogs.org, but without the summary. I would like to know, why? and how long is it going to continue doing that.

While PFblogs.org is the world's best aggregator, it is annoying to not see the sumary that is suppose to be there.

While PFblogs.org is the world's best aggregator, it is annoying to not see the sumary that is suppose to be there.

The 400 Richest Americans -Top 5

1. Bill Gates, Microsoft, $53 billion

2. Warren Buffett, investor, $46 billion

3. Sheldon Adelson, casino magnate, $20.5 billion

4. Larry Ellison, Oracle, $19.5 billion

5. Paul Allen, Microsoft, $16 billion

According to the USA Today, the founder of my favorite fast food place is even on the list:

S Truett Cathy $1.2 billion Atlanta, GA 85 Chick-fil-A

Now if only I can make my own one billion.

Wednesday, September 20, 2006

Seeking Advice

I have learned just how crooked Providian is. Most credit cards apply payments to the oldest balance first. Not, Providian though. No wonder Dave Ramsey calls them all kinds of bad names. Here is how Providian applies payments:

1st - Any Card Fees

2nd - Balance with lowest APR

Since Balance Transfers (mine is well over a year old) is the same as cash advances, it has a higher APR.

Because of this, I have considered taking up the offer from Kansas Farm Bureau to transfer remaining balance to an Intrust Visa at 0% for 6 months. I should more easily be able to pay this debt off by the end of the year. Should I do this, or is there something I should do. Would really love to hear from all you Ramsey fans.

Monday, September 18, 2006

A Surprise In Today's Mail

I received quite a surprise, this afternoon, when I woke up and checked my mailbox. It has been a couple months now, since I refinanced my car with my local credit union, getting rid of Nuvell, who was charging me higher interest rates. So I wasn't expecting to see another refund check in the mail from Nuvell. However, that is exactly what I received today. Infact a check for $1012, marked as cancelation of life and disability (insurance). I only had Nuvell a few months, and am amazed that I had even paid that much. I am thanking God for this check it will make some great inroads to paying off my credit card as well as making a nice payment on my car loan to. Once I have paid extra on the car loan, I will switch to weekly payments, so that I can keep the interest rates down and get that car loan paid off sooner.

I will use $400 for the credit card, while another $400 for the car loan and use the other $200 to pay on the medical bills (or maybe car tags - due in October).

With this infusion, from God, I beleive that I am well on my way to meet my ambitious goal of having the credit card and the home improvement loan paid off by the end of the year.

I will use $400 for the credit card, while another $400 for the car loan and use the other $200 to pay on the medical bills (or maybe car tags - due in October).

With this infusion, from God, I beleive that I am well on my way to meet my ambitious goal of having the credit card and the home improvement loan paid off by the end of the year.

Friday, September 15, 2006

Personal Home Loan Mortgages

Yesterday, I was asked to take a look at www.personalhomeloanmortgages.com and give my honest opinion. I will again try to do that through the eyes of Dave Ramsey. My first look at the website and I was impressed by how nice it looked. It was well laid out. However, www.personalhomeloanmortgages.com the wbsite which offers mortgage offers the lowest quotes from no more then two lenders, seems focused on Audgestable Rate Mortgage's (ARM) and Home Equity Line of Credit (HELOC) or as Dave Ramsey calls them HEL (aka hell). While you John Cummuta teaches that you may have to get a loan to buy your first house, Ramsey encourages first time home buyers (as well as everyone else buying a home) to save and pay cash.

The problem with ARM's is that people who hold such loans can be surprised and ruin their budgets if interest rates go up causing their monthly payments to also rise. This is why Dave ramsey, has said repeatedly to avoid ARM's at all cost.

As for HELOC's, the biggest problem I find with HELOC's is that people use these loans to consolidate their debts, including credit card debts, but then start charging up the now paid off credit card. As a result in just a few months, someone who took out a HELOC, could easily find theirselves in worse financial shape then before they put their home at risk with such a stupid loan. My advise, if you do take out a HELOC, you must be committed to not borrow anything else and to getting that loan paid off ASAP.

If you have enough money saved for a healthy down payment, feel free to take a look at www.personalhomeloanmortgages.com and see what kind of rates they might be able to offer you. I would still recomend that you say 100% of the cash, but as long as you have a good 25-50% to put down, I won't criticize you for borrowing for your first home, as long as that home is not more then you can afford.

The problem with ARM's is that people who hold such loans can be surprised and ruin their budgets if interest rates go up causing their monthly payments to also rise. This is why Dave ramsey, has said repeatedly to avoid ARM's at all cost.

As for HELOC's, the biggest problem I find with HELOC's is that people use these loans to consolidate their debts, including credit card debts, but then start charging up the now paid off credit card. As a result in just a few months, someone who took out a HELOC, could easily find theirselves in worse financial shape then before they put their home at risk with such a stupid loan. My advise, if you do take out a HELOC, you must be committed to not borrow anything else and to getting that loan paid off ASAP.

If you have enough money saved for a healthy down payment, feel free to take a look at www.personalhomeloanmortgages.com and see what kind of rates they might be able to offer you. I would still recomend that you say 100% of the cash, but as long as you have a good 25-50% to put down, I won't criticize you for borrowing for your first home, as long as that home is not more then you can afford.

Thursday, September 14, 2006

You May Have Noticed

You may have noticed that I recently added a contact (voicemail) number to the right sidebar. It is a number that I picked up free. In this way, the national media (not to mention, anyone else)will find it easier to get ahold of me. While it can allow cmputer to computer calling, I only use the free voicemail service. Below are the details of tthis great new service.

I just learned about this new service called NetZero Voice, which offers free computer-to-computer calling between NetZero Voice Members. Sign-up today and we can talk for free!

NetZero Voice lets you call anyone, anytime, anywhere in the world - FREE*! All you and your friends need is NetZero Voice. You also get voicemail, caller ID, call waiting and much more. You can do all this and make calls using any Internet connection - including dial-up and broadband.

NetZero Voice can be downloaded in just a few minutes so we’ll be talking through the Internet for free in no time. Just go to http://www.netzerovoice.com/refervoice and sign-up today.

Don't forget to enter my NetZero member ID (princeofthrift) to your contact list so we can keep in touch easier.

Get started NOW FREE*!

What Is An Annuity?

After reading a recent post Sean asked, what an annuity was. Well Sean let me try to explain it to you.

Bankrate.com probably has the best description when it describes them this way,

There are two types of annuities, fixed and variable. Fixed annuities carries an interest rate that starts out as a fixed percentage and is usually adjusted annually. On the other hand a variable annuity is a bit more complex. With a variable annuity the purchaser selects from a list of mutual funds and his payments are invested in the funds he picks; future payouts depend on the funds' performance over the years.

In addition, the interest may be no better (or barely) then a common savings account.

In its most general sense, an annuity is an agreement for one person or organization to pay another a stream or series of payments. Usually the term “annuity” relates to a contract between you and a life insurance company, but a charity or a trust can take the place of the insurance company.

Bankrate.com probably has the best description when it describes them this way,

An annuity is a life insurance contract sold by insurance companies, brokers and other financial institutions. It is usually sold as a retirement investment and is paid for before retirement in exchange for lifetime payments after retirement. Before talking about pros and cons, let's look at what they're selling.

There are two types of annuities, fixed and variable. Fixed annuities carries an interest rate that starts out as a fixed percentage and is usually adjusted annually. On the other hand a variable annuity is a bit more complex. With a variable annuity the purchaser selects from a list of mutual funds and his payments are invested in the funds he picks; future payouts depend on the funds' performance over the years.

What's good about an annuity?

Assuming you're buying it with after-tax dollars, here are some of the pros of investing in an annuity:

Lifetime income is guaranteed

Earnings are tax-deferred

There is no limit on how much you can contribute

There are no income restrictions

You can switch investments within your contract without paying taxes

You get a premium for outliving your life expectancy

What's bad about an annuity?

Fee and commissions can be high and cut deeply into your return. Look for low-load or no-load contracts with low fees.

Annuities are generally bought with after-tax dollars.

At payback time, income is taxed as ordinary income, even if most of it is from capital gains. Not good if you're in a 28 percent or 39.6 percent income-tax bracket and your capital gains tax rate is 20 percent.

Annuity talk can sound like doublespeak, making it hard to separate the good contracts from the bad ones.

An annuity is a long-term investment, and bailing out early can kick up penalties, taxes and surrender charges.

You could be paying for life insurance you don't need.

You need a long stretch of time and a big chunk of money to make it work.

In addition, the interest may be no better (or barely) then a common savings account.

Wednesday, September 13, 2006

Carnivals - Week of Sept 10, 2006

Below are the 4 carnivals that I am aware of, that the Prince made it into.

Festival of Frugality

Carnivalof Personal Finance

Carnival of Debt Reduction

and finally

The Carnival of the Capitalists.

Hope you enjoy the carnivals this week.

Financial One Through Dave Ramsey's Eyes

I was asked yesterday to take a look at www.financialone.com and give my honest opinion. The website offers quotes from various companies, that offer Life Insurance, Mortgages and Annuities. According to the website, "you can't find an online shopping system that quotes more companies." Sounds good doesn't it.

However, I adhear to Dave Ramsey's teachings and so I have some strong opinions on www.financialone.com's offerings, so I will try to do that through the eyes of Dave Ramsey. For example, I have no problem with the offering of Life Insurance. Everyone needs that service or will, to provide for our family after our death. With mortgages, some may need to take a mortgage out to buy their first home, however any subsequent homes should be paid for with savings and the sale of the previous home.

Finally, www.financialone.com offers annuities and that is a service I have a really big problem with. Fore example, Dave Ramsey's website says, "Dave owns no fixed annuities and does not suggest them as part of your investment plan. Dave teaches that there are no good places for fixed annuities in your investment plan. Simply stay away from these." In addition, Dave says, "Variable Annuities (VA's) cause more confusion than any other financial product."

Overall, I would recomend that you avoid Financial One.

Monday, September 11, 2006

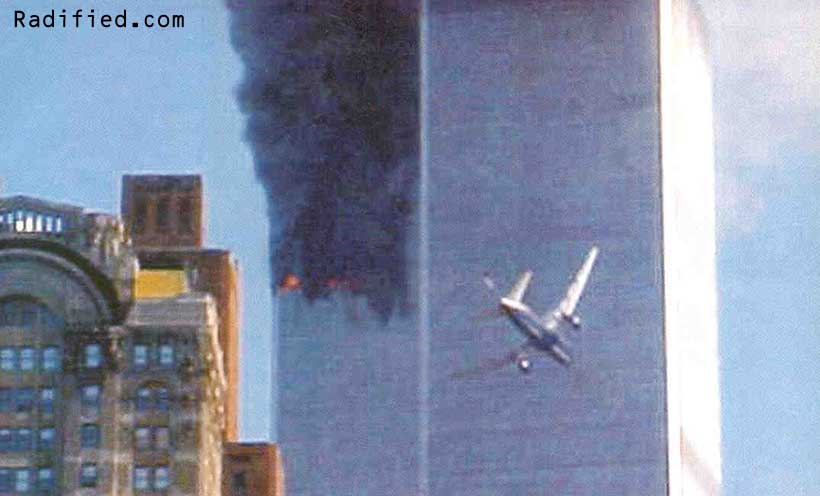

Remembering - Where Were You?

Remembering that day 5 years later. Do you remeber, where you were that day, when you heard the news? I was bed, when I was awaken, by a friend calling, urging me to turn the TV on. Refusing to tell me what was going on, I turned on. When I seen the 2nd plane hit, I made the comment, that THESE CRASHES WERE "NO ACCIDENT." sO WHERE WERE YOU?

Sunday, September 10, 2006

Extra Money On Next Paycheck

Well, I knew I would get some extra money over the course of the month, but I didn't really plan for this. I was called in, on my day off this week, because one of my employees called in sick, and I am only one of 2 other people on my crew that knows how to do her job. So, that is giving me an extra 9.?? hours of overtime. Something that the company does not like anyone getting. I addition, it was a holiday week, so I will have about 8 hours holiday pay. All this means I will get paid about 48 hours of regular pay and a little more then 9 hours of time and half. If I could keep bringing in this kind of money, I would have a better chance of meeting my goal, of having both the providian Credit Card as well as the PaceSetter Windows (Crocked company) loan paid off by the end off the year. Once they are both paid off, I can focus my attention on decreasing my Car loan and trying to get it paid off within the next 2 years, rather then 4 years.

Please Lord, I beseach you to provide the funds neccesary to meet my goals. It is no secerate, especially if you follow my personal bog, over on livejournal, that I have a strong desire to serve my Lord Jesus Christ, through the mission field. Of course, here in Topeka, I also have a vision of a new and more humanitarian way to serve those in need for help with food.

Please Lord, I beseach you to provide the funds neccesary to meet my goals. It is no secerate, especially if you follow my personal bog, over on livejournal, that I have a strong desire to serve my Lord Jesus Christ, through the mission field. Of course, here in Topeka, I also have a vision of a new and more humanitarian way to serve those in need for help with food.

Thursday, September 7, 2006

Credit Is Not Your Friend

I recently had a response to a post from "Bella," who asked,

In addition she asked,

Here is the response, I emailed back to her:

Bella -

Let's look at why the cash only lifestyle is really better then one built on credit.

Credit does nothing but diminish your lifestyle over time. It makes everything cost more. Yes, you probably will need a loan to buy your first home. But after you pay off that mortgage and begin saving, moving to another home should involve nothing more then selling your current home and using the proceeds to buy your next home. If you need more to make the purchase, simply take it from your investment savings. That might be hard to imagine right now, but you are going to prefer a life free from all loans, charge accounts and credit cards...and you WILL be able to do it.

Throughout my blog, I will probably repeat this many times, and in many ways, but you must understand that the idea using credit enhanses your lifestyle is a bold-face lie. That is mathematically impossible. Yes, it can appear to get you more stuff in the begining, but after a while most of your money is promised away to credit payments every month, so you end up living a diminished, rather then enhanced lifestyle.

Think about this: When someone offers you credit, they are not giving you anything. If they offer you a $1,000 Visa card, they are not giving you $1,000. They are NOT adding a single dime into your life. They are simply moving up the date at which you can spend money that you will have to earn - and they are charging you a terrible price for letting you "use" $1,000 of their money.

So the net effect is that - when someone offers you credit - they will actually reduce, not add to, the money you will have to spend over your lifetime.

Credit does only one thing: it raises the price of everything you buy with it. Credit takes more money away from you than the actual value (purchase price) of whatever you buy on credit. Usually a lot more then you think. And that extra money you are giving to the credit company is the same money you should be investing to produce your future retirement income.

People re literally giving away their future wealth, just to have things right now, instead of waiting until they can actually afford it. However; the true cost of credit is much more then they realize. So, like you (and myself) they drown in credit interest, and wake up one day, old and wanting to stop working, only to realize they can't stop - because they still owe more and more interest on more and more debt. Debt they used to buy gadgets, trinkets, and other "had to have" junk they have long ago stuffed into the attic, basement, closets and/or garage.

As for me, I want to change all that before I get old. The time is now. For you, being younger, changing your habits now, will be far better then for me. You will have more time for you new retirement savings to grow bigger, allowing you to have more to retire on. But, you must start today.

As for the 3-7 years, I again ask who teaches is the course based on? If it's John Cummuta's, who teaches everything paid off, including the mortgage in 5-7 years, then yes it is possible. Even Dave Ramsey, says you should be able to pay everything, EXCEPT the mortgage off in 18 months or less. It is all just a matter of becoming motivated and applying yourself, and not taking out any more credit whatsoever.

Basically to answer your first question, in short, yes it is bad, living on credit will NOT get you ahead ever.

Hi 'Prince': I have bad credit from about 5-6 years ago...got sick..used credit to live on...anyway..I just recently got one of those high interest credit cards to begin to build my credit again (note: I haven't paid any back on the bad credit) I am in school, adult, on a disability, it is high on the card, but I thought this would help me to build up credit again...is this wrong? ...will be looking into your blogging more.

In addition she asked,

I am in college as I said..there is a noncredit course coming up that is debt free and sounds a lot like this one..it says you can be debt free in 3-7 years..which sounds like the same system...could this be true?

Here is the response, I emailed back to her:

Bella -

Let's look at why the cash only lifestyle is really better then one built on credit.

Credit does nothing but diminish your lifestyle over time. It makes everything cost more. Yes, you probably will need a loan to buy your first home. But after you pay off that mortgage and begin saving, moving to another home should involve nothing more then selling your current home and using the proceeds to buy your next home. If you need more to make the purchase, simply take it from your investment savings. That might be hard to imagine right now, but you are going to prefer a life free from all loans, charge accounts and credit cards...and you WILL be able to do it.

Throughout my blog, I will probably repeat this many times, and in many ways, but you must understand that the idea using credit enhanses your lifestyle is a bold-face lie. That is mathematically impossible. Yes, it can appear to get you more stuff in the begining, but after a while most of your money is promised away to credit payments every month, so you end up living a diminished, rather then enhanced lifestyle.

Think about this: When someone offers you credit, they are not giving you anything. If they offer you a $1,000 Visa card, they are not giving you $1,000. They are NOT adding a single dime into your life. They are simply moving up the date at which you can spend money that you will have to earn - and they are charging you a terrible price for letting you "use" $1,000 of their money.

So the net effect is that - when someone offers you credit - they will actually reduce, not add to, the money you will have to spend over your lifetime.

Credit does only one thing: it raises the price of everything you buy with it. Credit takes more money away from you than the actual value (purchase price) of whatever you buy on credit. Usually a lot more then you think. And that extra money you are giving to the credit company is the same money you should be investing to produce your future retirement income.

People re literally giving away their future wealth, just to have things right now, instead of waiting until they can actually afford it. However; the true cost of credit is much more then they realize. So, like you (and myself) they drown in credit interest, and wake up one day, old and wanting to stop working, only to realize they can't stop - because they still owe more and more interest on more and more debt. Debt they used to buy gadgets, trinkets, and other "had to have" junk they have long ago stuffed into the attic, basement, closets and/or garage.

As for me, I want to change all that before I get old. The time is now. For you, being younger, changing your habits now, will be far better then for me. You will have more time for you new retirement savings to grow bigger, allowing you to have more to retire on. But, you must start today.

As for the 3-7 years, I again ask who teaches is the course based on? If it's John Cummuta's, who teaches everything paid off, including the mortgage in 5-7 years, then yes it is possible. Even Dave Ramsey, says you should be able to pay everything, EXCEPT the mortgage off in 18 months or less. It is all just a matter of becoming motivated and applying yourself, and not taking out any more credit whatsoever.

Basically to answer your first question, in short, yes it is bad, living on credit will NOT get you ahead ever.

Monday, September 4, 2006

Steve Irwin Dead

With all the best wishes to his family, Steve will be missed, everyone the world over!

Washington Post

CAIRNS, Australia -- Steve Irwin, the hugely popular Australian television personality and conservationist known as the "Crocodile Hunter," was killed Monday by a stingray while filming off the Great Barrier Reef. He was 44.

Irwin was at Batt Reef, off the remote coast of northeastern Queensland state, shooting a segment for a series called "Ocean's Deadliest" when he swam too close to one of the animals, which have a poisonous barb on their tails, his friend and colleague John Stainton said.

"He came on top of the stingray and the stingray's barb went up and into his chest and put a hole into his heart," said Stainton, who was on board Irwin's boat at the time.

Crew members aboard the boat, Croc One, called emergency services in the nearest city, Cairns, and administered CPR as they rushed the boat to nearby Low Isle to meet a rescue helicopter. Medical staff pronounced Irwin dead when they arrived a short time later, Stainton said.

Saturday, September 2, 2006

Nightmare Mortgages

Dave Ramsey has been warning you for years. Now Yahoo News has published an article titled, Nightmare Mortgages, that is must read, if you aren't convinced that ARM's are to be avoided.

Why would they skyrocket?

It's the way they are written, ARM's are just what they are called Adjustable Rate Mortgages.

I think, some peoples eyes are really going to be opened up now.

For cash-strapped homeowners, it was a pitch they couldn't refuse: Refinance your mortgage at a bargain rate and cut your payments in half. New home buyers, stretching to afford something in a super-heated market, didn't even need to produce documentation, much less a downpayment.

Those who took the bait are in for a nasty surprise. While many Americans have started to worry about falling home prices, borrowers who jumped into so-called option ARM loans have another, more urgent problem: payments that are about to skyrocket.

Why would they skyrocket?

It's the way they are written, ARM's are just what they are called Adjustable Rate Mortgages.

The option adjustable rate mortgage (ARM) might be the riskiest and most complicated home loan product ever created. With its temptingly low minimum payments, the option ARM brought a whole new group of buyers into the housing market, extending the boom longer than it could have otherwise lasted, especially in the hottest markets. Suddenly, almost anyone could afford a home -- or so they thought. The option ARM's low payments are only temporary. And the less a borrower chooses to pay now, the more is tacked onto the balance.

The bill is coming due. Many of the option ARMs taken out in 2004 and 2005 are resetting at much higher payment schedules -- often to the astonishment of people who thought the low installments were fixed for at least five years. And because home prices have leveled off, borrowers can't count on rising equity to bail them out. What's more, steep penalties prevent them from refinancing. The most diligent home buyers asked enough questions to know that option ARMs can be fraught with risk. But others, caught up in real estate mania, ignored or failed to appreciate the risk.

I think, some peoples eyes are really going to be opened up now.

My September NCN Network Update

I knew when I started the month of August that I wasn't going to make the inroads on my debt repayment plan, like I had in previous months (and September looks to be the same) Just paying the minimal amounts on each debt, as I once again try to get my budget lined out. It still was disappointing to see that I vitually nothing to my debts (I maybe $75 ahead, but the phone system to get my balance at Amerifirst Mortgage (PaceSetter Windows bank) formerly Federal Deversified has been down. I was getting use to seeing the total debt get smaller and smaller with every month. My goal of paying off $2,500 by the end of the year, will definitely be even more difficult.

However, I am $33 (actually $32.55) away from getting my first paycheck from Google Adsense. In addition, I have signed up for PayPerPost and in the first 2 days I have made 2 posts (though I am allowed as many as 3 posts per day, as long as they aren't consecutive) and am set to earn $13 in about 30 days, when they pay for the posts. I expect that I will make a post, latter this afternoob, after I wake up that will pay $10 for 10 words and a photograph. If I can meet up with my neighbor today to photograph my ebay items, I will ask him to snap a picture that would qualify. In addition if anyone is interested in signed up, place my email in the referer box and I will split the referal fee with you, once I receive it. That is, if you give me your pay pay email addy so I can...mine is the same address that is listed in my conatct box the right (frugal -AT- surbaugh.com) of course replace AT with @ and eleminate the spaces.

Anyway, if I can get a few hundred dollars in the next month from these revenue makers, I could easily get my credit card payed off once and for all, as well as medical bills and the loan to Amerifirst. All in all I would need to raise about $2,900 to accomplish that goal. If I could keep up that pace, especially if it was $1000/month, I could have my car paid off in a little less then 10 months, at which time I could call Dave Ramsey and scream, "I am Debt Free." What a day that would be, at which time I could eleminate the pay per post, or at least greatly cut back.

***Note final numbers are finally in....$17,327 till I am Debt Free, that's $10 less debt then my Aug 1st update****

Friday, September 1, 2006

PayPerPost Founder, Ted Murphy Arrested

I recently signed up for PayPerPost, who will pay me at least $2.50 for certain posts. If I had a digital video camera, or any video camera really, and could post my own videos, I could even get $35+ for some approved posts. Unfortunately though, I don't own a video. They even said they would pay me $10.50, if I made up some kind of stupid and creative rumor about them. Now, that sounds interesting. Rather then creating ads on blogs, I could write a rumor about them. However; before I could, I seen this news story,

PayPerPost Founder, Ted Murphy Arrested. It seems that the internet authorities didn't like this kind of marketing and the blurring of lines between every day bloggers and commercial bloggers. How dare, Murphy pay normal every day bloggers, primarily those that discuss personal finance, to do what they do best; blog. So, they had him arrested. Obviously, this has created an uproar, but since most of the bloggers are American, their complaints have fallen on deaf ears with the Chinese authorities.

Soon To Try Ebay Again

I was talking to neighbor today, and he is going to help get some items photographed to put up on ebay. I don't have much valuable stuff, but will put a number of books, VHS movies, computer parts, sheetrock tape, and some other small items. I do of course have a coffee table and a metal desk to sale to, but am not sure how to try to sale them. Last time, I tried to ebay items I didn't do very well. Which confuses me, when I see a single Lay's potato chip sell for well over $1000.

Anyway, I am hoping to get at least $100 from my upcoming auctions, and would really rather get closer to $2000.

Any advice? What do you guys think?

Subscribe to:

Comments (Atom)